Susquehanna Intercontinental Team, LLP (SIG), a world investing, engineering, and investment decision organization, disclosed that it retains around $1.8 billion in Bitcoin trade-traded money (ETFs) through a 13F-HR filing submitted to the Securities and Exchange Commission (SEC), delivering a in-depth breakdown of SIG’s investment decision portfolio.

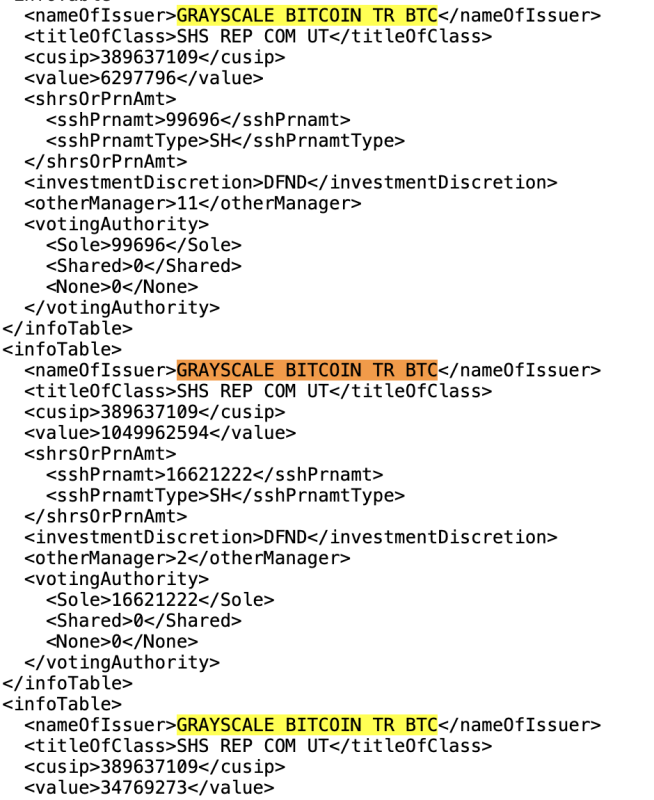

The filing reveals the investment companies most significant positions ended up in Grayscales Bitcoin ETF GBTC, totaling $1,091,029,663.

The paperwork also unveiled that SIG retains positions in ARK 21SHARES BITCOIN ETF, BITWISE BITCOIN ETF TR, BITWISE Funds Trust (BITCOIN AND ETHER), FIDELITY Smart ORIGIN BITCOIN, FRANKLIN TEMPLETON Digital BITCOIN ETF, World X BITCOIN Pattern, INVESCO GALAXY BITCOIN ETF, ISHARES BITCOIN TR, PROSHARES TR Brief BITCOIN, PROSHARES TR BITCOIN STRATE, PROSHARES TR BITCOIN & ETHER, VALKYRIE BITCOIN FD, VALKYRIE ETF Belief II BITCOIN AND ETHE, VALKYRIE ETF Have confidence in II BITCOIN MINERS, VALKYRIE ETF Rely on II BITCOIN FUTR LEV, VANECK BITCOIN TR, VOLATILITY SHS TR 2X BITCOIN STRAT, and WISDOMTREE BITCOIN FD.

The full mixed quantity of belongings across all these ETFs include up to above $1.8 billion at the time of creating.

Apparently ample, the financial investment company noticeably holds $4,037,637 value of ProShares quick bitcoin ETF, which aims to offers investors the potential to profit on times when BTC drops in value. In addition to this, SIG also retains $1,004,552 well worth of Valkyrie Bitcoin Futures Leveraged Tactic ETF and $97,856,513 really worth of Volatility Shares 2x Bitcoin ETF, to profit even further on days when the cost of BTC is rising.

Bitcoin ETFs supply institutions a controlled and available way to achieve publicity to Bitcoin’s value movements, but presents up the potential for buyers to right hold the bitcoin by themselves.

SIG’s disclosure of holding about $1.8 billion in Bitcoin ETFs demonstrates the escalating development of institutional adoption and investment in Bitcoin as component of a diversified expense strategy. Market place scientists and analysts expect far more institutions to file these 13F-HR paperwork with the SEC in the coming months, revealing specifically who has been buying place Bitcoin ETFs considering the fact that they went live before this year in January.

The sights and thoughts expressed herein are the views and views of the creator and do not necessarily replicate these of Nasdaq, Inc.