(Bloomberg) — Japan’s lifestyle insurers are very likely to obtain more domestic sovereign bonds this calendar year right after the finish of detrimental interest charges in the nation.

The businesses will lay out their expense programs for the new fiscal 12 months starting off this month. International investors pay out near interest to the ideas of daily life insurers, which have mixed property of $2.6 trillion, as they typically transfer marketplaces. There is a individual emphasis on whether they will repatriate resources. The insurers are also envisioned to flag the ongoing sale of overseas debt that is hedged towards the yen’s appreciation simply because of the affiliated prices for defense.

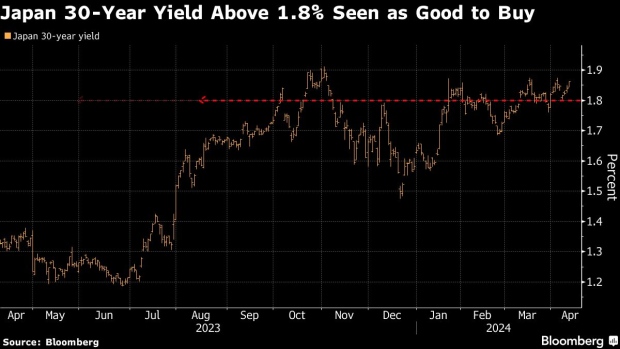

In January, a lot of of the insurers mentioned they were holding off on paying for JGBs thanks to minimal yields. The Financial institution of Japan taken off the sub-zero fascination rate and yield-curve handle application in March and is predicted to even more raise prices later on this calendar year. The produce on the 30-year sovereign securities, favored by lifestyle insurance organizations to fulfill their extended-term obligations, has risen nearly 30 basis factors this yr to 1.92%, in accordance to Bloomberg knowledge.

“Yields on super-long securities are approaching 2%, which is a great amount for lifestyle insurers to invest in,” said Ayako Sera, industry strategist at Sumitomo Mitsui Trust Bank Ltd. “As yen-denominated securities supply a specific amount of returns, they will possibly proceed to reduce overseas bonds with currency hedges. Even so, due to the fact it’s difficult to see extra than 2% return from the Japanese bonds, they will also incorporate some abroad personal debt with out hedges.

Fukoku Mutual Lifetime Insurance coverage Co., Meiji Yasuda Daily life Insurance coverage Co. and Japan Write-up Coverage Co. all stated in January that they would hold off from obtaining domestic sovereign bonds till yields rose and amid uncertainty encompassing the BOJ’s monetary plan.

Life and non-life insurers ordered a web ¥4.4 trillion ($29 billion) of Japanese bonds in the fiscal yr ended March 31, in accordance to Bloomberg estimates using info from the Japan Securities Dealers Association, adding to a net obtaining of ¥5.8 trillion the prior year. Lifetime insurers offloaded a net ¥2.4 trillion of international bonds in fiscal 2023 soon after a document sale of ¥14 trillion a yr before, according to the most current info from the Ministry of Finance.

Expensive hedging charges have created existence insurers stay away from international debt with hedges in the previous handful of years. While the hole in between US and Japanese 10-calendar year yields is continue to at about 3.5 percentage details, the return from the US notes becomes adverse immediately after using into account the price tag of hedging in opposition to forex fluctuations, at around 5.4%.

“Life insurers could also indicate buys of foreign sovereign and company credit card debt without having forex hedges,” claimed Eiichiro Miura, normal manager of fixed-revenue financial investment at Nissay Asset Management Corp. “While the produce gap remains huge and the Federal Reserve is envisioned to provide desire-price cuts only at a gradual tempo, the dollar-yen is not likely to fall that a lot. The BOJ’s level hike failed to strengthen the yen, which is also a purpose for not having forex hedges.”

The yen has weakened extra than 7.9% against the greenback this year, generating it among the worst performing significant currencies. Even now, the yen is expected to reinforce to 142 for every greenback by yr-end, compared with a forecast of 135 created at end of final 12 months, according to median estimates in Bloomberg surveys. Swap markets are forecasting two Fed fascination-charge cuts this calendar year, as opposed with a lot more than six cuts predicted at the conclusion of 2023.

As the yen reached its lowest level due to the fact 1990 as of Thursday at 153.32 for every dollar and is envisioned to rebound towards the conclude of this 12 months, the forex is a hard component for financial commitment abroad.

“Even though concerns about the pace of yen’s appreciation have eased, investors even now see the yen strengthening,” reported Hideo Shimomura, senior portfolio supervisor at Fivestar Asset Administration Co. “They have to purchase overseas personal debt on dips in the dollar-yen trade level. It isn’t uncomplicated.”

The nation’s life insurers such as Nippon Daily life Coverage Co., Sumitomo Lifetime Coverage Co., Dai-ichi Life Insurance policies Co., Japan Post Insurance coverage Co. and Meiji Yasuda Life Insurance policies Co., will release their investment decision strategies this week and upcoming.

©2024 Bloomberg L.P.