Table of Contents

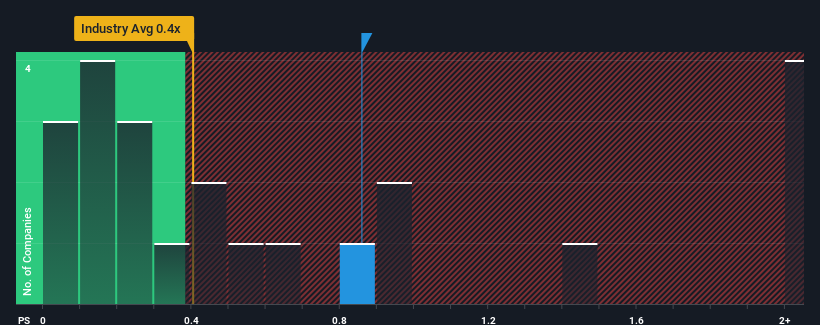

With a median value-to-sales (or “P/S”) ratio of shut to .4x in the Communications field in Hong Kong, you could be forgiven for sensation indifferent about Chengdu SIWI Science and Technological know-how Company Limited’s (HKG:1202) P/S ratio of .9x. Having said that, investors could be overlooking a obvious chance or opportunity setback if there is no rational foundation for the P/S.

Look at out our most recent evaluation for Chengdu SIWI Science and Technological innovation

How Has Chengdu SIWI Science and Technology Done Just lately?

Chengdu SIWI Science and Engineering has been accomplishing a decent job recently as it is been rising earnings at a fair speed. Possibly the expectation shifting ahead is that the income progress will keep track of in line with the broader sector for the near expression, which has saved the P/S subdued. Individuals who are bullish on Chengdu SIWI Science and Technological know-how will be hoping that this is just not the situation, so that they can choose up the inventory at a reduced valuation.

Despite the fact that there are no analyst estimates out there for Chengdu SIWI Science and Technological innovation, just take a glimpse at this totally free info-abundant visualisation to see how the firm stacks up on earnings, revenue and cash flow.

How Is Chengdu SIWI Science and Technology’s Revenue Progress Trending?

There is certainly an inherent assumption that a firm ought to be matching the business for P/S ratios like Chengdu SIWI Science and Technology’s to be thought of affordable.

Retrospectively, the very last yr shipped a decent 6.6% gain to the company’s revenues. However, lamentably profits has fallen 20% in combination from 3 yrs back, which is disappointing. Thus, it is really honest to say the earnings expansion a short while ago has been undesirable for the corporation.

In contrast to the enterprise, the rest of the market is expected to mature by 15% over the upcoming calendar year, which seriously puts the company’s new medium-phrase profits drop into perspective.

With this info, we discover it about that Chengdu SIWI Science and Know-how is investing at a quite similar P/S when compared to the marketplace. It appears to be most buyers are ignoring the new very poor progress charge and are hoping for a turnaround in the company’s organization prospective clients. Only the boldest would presume these price ranges are sustainable as a continuation of new profits traits is probable to weigh on the share rate eventually.

The Bottom Line On Chengdu SIWI Science and Technology’s P/S

We might say the selling price-to-revenue ratio’s electrical power isn’t primarily as a valuation instrument but instead to gauge recent investor sentiment and upcoming expectations.

The reality that Chengdu SIWI Science and Technological know-how at the moment trades at a P/S on par with the rest of the industry is shocking to us because its current revenues have been in decline in excess of the medium-term, all although the business is established to develop. Even although it matches the business, we are uncomfortable with the latest P/S ratio, as this dismal profits overall performance is not likely to assistance a additional good sentiment for lengthy. Except if the current medium-time period situations enhance markedly, traders will have a tough time accepting the share selling price as fair price.

Ahead of you settle on your view, we’ve uncovered 2 warning signs for Chengdu SIWI Science and Technology (1 is a bit disagreeable!) that you should be conscious of.

If these threats are earning you rethink your belief on Chengdu SIWI Science and Engineering, take a look at our interactive list of substantial excellent shares to get an thought of what else is out there.

Valuation is intricate, but we are assisting make it very simple.

Uncover out regardless of whether Chengdu SIWI Science and Technological innovation is possibly more than or undervalued by examining out our comprehensive evaluation, which contains truthful value estimates, challenges and warnings, dividends, insider transactions and fiscal overall health.

View the Cost-free Investigation

Have suggestions on this article? Involved about the material? Get in contact with us straight. Alternatively, electronic mail editorial-crew (at) simplywallst.com.

This short article by Just Wall St is normal in nature. We deliver commentary primarily based on historic info and analyst forecasts only working with an impartial methodology and our content are not intended to be financial suggestions. It does not constitute a recommendation to invest in or promote any inventory, and does not consider account of your objectives, or your economical circumstance. We goal to deliver you extensive-expression concentrated examination driven by fundamental info. Observe that our evaluation could not aspect in the most up-to-date rate-delicate company announcements or qualitative materials. Simply Wall St has no position in any shares talked about.